The importance of shop-floor logistics planning for SKD production lines

The Importance of In-Plant Logistics Planning for SKD Production Lines – with References to Leading Global OEMs

- SKD’s inherent logistics sensitivity

- Parts sit between CKD and CBU: large pre-assembled modules (body, engine, chassis) are bulky, fragile and require special dunnage. Once the plan is wrong you cannot compensate with “small parts + rack” solutions as in CKD.

- Overseas plants usually run “zero stock”: limited warehouse space and slow customs force a 48-hour port-to-line requirement. The domestic plant must therefore synchronise kitting to ship schedules, not factory shifts; any error stops the overseas line.

- Packaging–transport–line-side form one system: SKD racks must fit densely into 40 HQ containers, be forklift/AGV-compatible at the foreign plant and allow no re-packing. All three scenarios have to be validated during the design phase.

- Four value levers of logistics planning on SKD lines

a) Efficiency – “one-piece flow” and ship-to-line

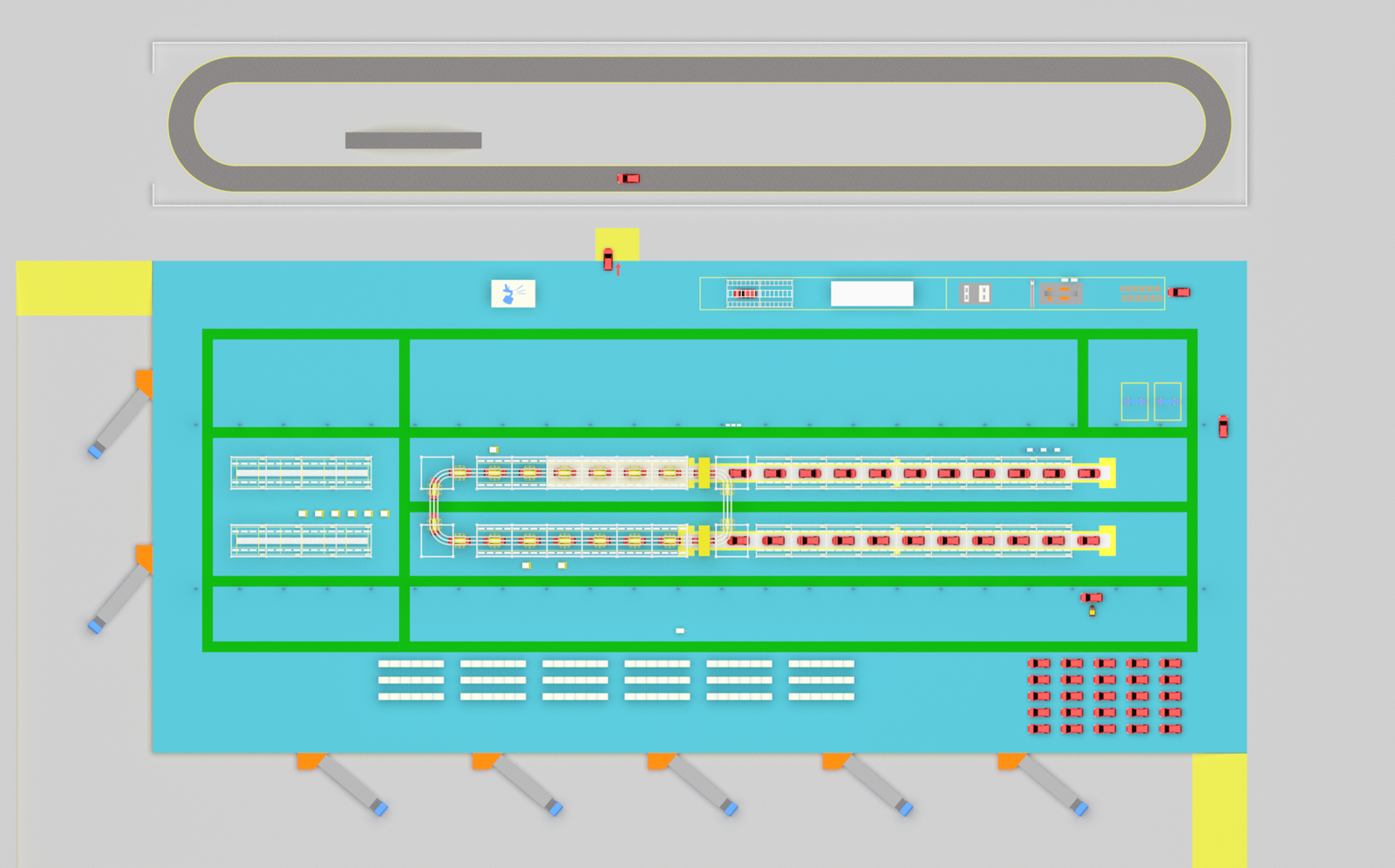

Domestic best practice is to re-sequence large SKD modules in the exact overseas assembly order, kit them at “ship-set” level and move them by AGV or EMS directly to the stuffing lane, cutting >50 % re-handling time.

Geely Chunxiao KD shop uses AGV “goods-to-person” plus KDMS to raise takt from 120 to 180 sets/day (target 240).

b) Cost – higher container fill and lower freight

3-D stuffing simulation done at shop-floor level finds the optimum stacking angle for every SKD module, raising 40 HQ capacity by 8-12 % and directly reducing sea freight.

SAIC MG India rotated the “engine + front suspension” module 90° inside the plant; fill went from 28 to 32 sets/container, saving ~12 M RMB/year.

c) Quality – zero damage and zero miss-build

High-value SKD modules cannot be reworked overseas. A “protection–transport–line-side” rack is validated on the domestic line, shipped with the set and used at the overseas plant – “zero re-pack, zero floor touch”. Damage rate dropped from 1.2 % to 0.15 %.

Vision systems take a 9-grid photo of every set; overseas quality issues can be traced to the exact domestic station within 24 h.

d) Flexibility – mixed-model capability

Geely and Great Wall use an automated SKD buffer + AGV loop; model change-over is <2 h, supporting six-model mixed production overseas.

A “pseudo-local” regional-hub concept (Chengdu, Xi’an, Hangzhou Bay) feeds SKD parts into a Southwest RDC and dispatches to any overseas plant within 72 h instead of 7 days.

- Benchmarks

| Dimension | Geely Chunxiao KD | SAIC-GM lean logistics | Toyota Thailand SKC* |

|---|---|---|---|

| Line feeding | AGV + KDMS | Sync supply + rack kit | Kanban + sequenced kit |

| Stuffing takt | 180/day (240 target) | 150/day | 160/day |

| Container utilisation | +12 % via 3-D sim. | +8 % via rack seq. | +10 % foldable racks |

| Traceability | Vision 9-grid | RFID + barcode | e-kanban + ANDON |

| Mixed-model | Auto buffer + AGV loop | Petal line-side layout | Modular + seq. switch |

*SKC = Semi-Knocked Complete (Toyota term)

- Key take-aways

- “Three-synch” at start: product data, packaging scheme and line-side layout developed together.

- Think in “ship takt”: derive domestic kitting schedule from vessel ETA to create port-plant-line integration.

- Dual sign-off: first run on domestic line, overseas plant confirms by video, then freeze rack design.

- Digital twin + AGV: validate container, AGV path and line-side space in a 1:1 model before steel is cut.

Conclusion

For SKD lines, in-plant logistics planning is no longer a “material-handling sideshow”; it is a strategic enabler that determines whether an overseas plant can ramp and break even in its first year. Leading OEMs now elevate SKD logistics to the same tier as the product platform itself, using digital, automated and flexible solutions to optimise the entire packaging–transport–line-side chain and support rapid, low-cost global expansion.